Find Out Which Taxable Income Band You Are In. Individual Life Cycle.

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified.

. Here are the income tax rates for personal income tax in Malaysia for YA 2019. Income Tax Rates and Thresholds Annual Tax Rate. On the First 2500.

Malaysia Non-Residents Income Tax Tables in 2020. The system is thus based on the taxpayers ability to pay. Coming back to the tax exemptions and reliefs these are all the ones that were announced by the government during the 2022.

These will be relevant for filing Personal income tax 2018 in Malaysia. A foreign individual who are employed in Malaysia has to provide hisher income data or chargeable income to the nearest LHDN branch. Chargeable Income RM Calculations RM Rate Tax RM 0 5000.

This page provides - Malaysia Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Tax rates in Malaysia. 20182019 Malaysian Tax Booklet.

Personal Tax 2021 Calculation. Income Tax Return for 2 YAs or more RM1000 to RM20000 or imprisonment or both and 300 of tax liability on conviction. The Personal Income Tax Rate in Malaysia stands at 30 percent.

Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment. Malaysia Personal Income Tax Rate. Chargeable Income RM Calculations RM Rate Tax M 0 5000.

Chargeable Income Calculations RM Rate TaxRM 0 - 5000. 22 October 2019. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes.

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Income tax rates 2022 Malaysia. The deadline for filing income tax in Malaysia is 30.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. There will be a two-year stamp duty exemption for the first RM300000 for houses priced up to RM500000. However non-residing individuals have to pay tax at a flat rate of 30.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. Ali work under real estate company with RM3000 monthly salary.

Here are the tax rates for personal income tax in Malaysia for YA 2018. On the first 5000. Malaysias finance minister presented the 2020 Budget proposals on 11 October 2019 and announced an increase in individual income tax rates by 2 percent.

On the First 5000. Total tax amount RM150. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

How Does Monthly Tax Deduction Work In Malaysia. The deadline for filing income tax in Malaysia is April 30 2019 for manual. 20182019 Malaysian Tax Booklet Personal Income Tax.

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher.

Introduction Individual Income Tax. Chargeable income RM20000. More On Malaysia Income Tax 2020 YA 2019 Hopefully this guide has helped answer your main questions about filing personal income taxes in Malaysia.

On the First 5000 Next 15000. Here are the progressive income tax rates for Year of Assessment 2021. The income tax filing process in Malaysia.

Heres How A Tax Rebate Can Help You Reduce Your Tax Further. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

For expatriates that qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an. Per LHDNs website these are the tax rates for the 2021 tax year. If you have no ideas to do the e-filing LHDN or you just need a clear guide to complete Malaysia Personal Income Tax 2021 this article is for you.

Flat rate on all taxable income. Total tax reliefs RM16000. Personal Income Tax Rate in Malaysia averaged 2729 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged. Annual income RM36000.

A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. These Are The Personal Tax Reliefs You Can Claim In Malaysia. Resident Individual Tax Rates for Assessment Year 2018-2019.

The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2 million ringgit US489 thousand. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. There is also an increase and expansion of the scope of individual tax reliefs eg for the provision of child-care and early childhood education medical expenses relief.

Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN. Here are the income tax rates for non-residents in Malaysia. Or 300 of tax payable in lieu of prosecution 20182019 Malaysian Tax Booklet Income Tax.

Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Tax rebate for self. Calculations RM Rate TaxRM A.

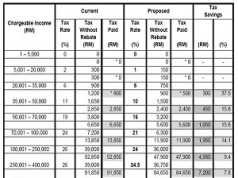

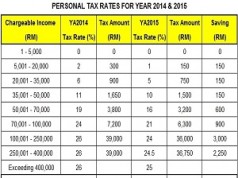

In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively. This notification has to be made by the foreigner within 2 months of the prior arrival in this country. First-time homebuyers will have stamp duty exemption for homes between RM300000 to.

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

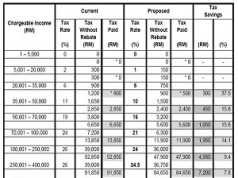

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Income Tax Malaysia 2018 Mypf My

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Personal Income Tax E Filing For First Timers In Malaysia Mypf My